ETH Price Prediction: Analyzing Short-term Technicals and Long-term Growth Trajectory Through 2040

#ETH

- Current technical positioning above 20-day MA suggests near-term bullish momentum with watchful eye on MACD convergence

- Fundamental catalysts including institutional adoption ($1.5B SharpLink buyback) and regulatory clarity support positive sentiment

- Long-term growth trajectory driven by DeFi expansion, scalability solutions, and increasing real-world utility through 2040

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

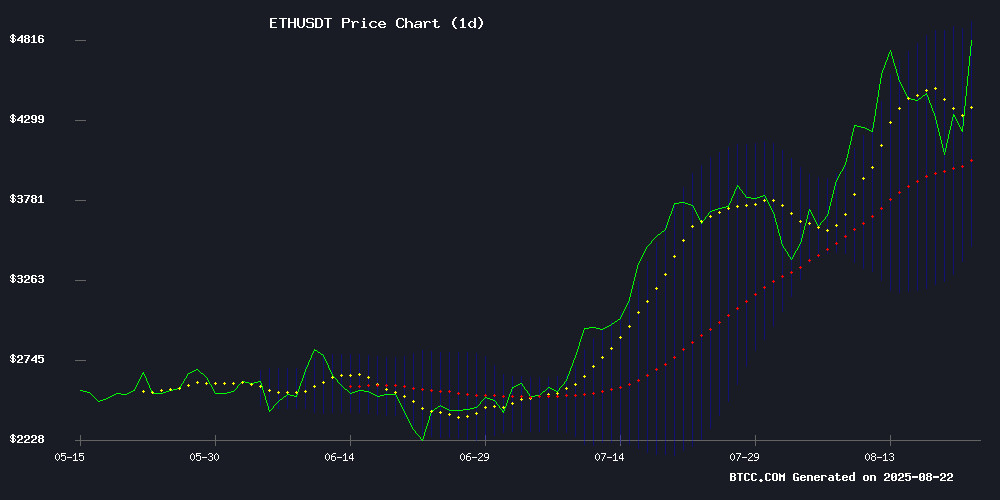

Ethereum is currently trading at $4,254.28, positioned above its 20-day moving average of $4,179.64, indicating near-term bullish momentum. According to BTCC financial analyst Mia, 'The price holding above the 20-day MA suggests underlying strength, though traders should monitor the MACD which remains in negative territory at -13.13, signaling potential consolidation before the next significant move.'

The Bollinger Bands show ETH trading within the upper band ($4,852.12) and middle band ($4,179.64), with the lower band providing support at $3,507.15. This configuration typically indicates controlled volatility with a slight bullish bias.

Market Sentiment Boosted by Institutional Adoption and Regulatory Clarity

Positive market sentiment is being driven by several fundamental developments. SharpLink's $1.5 billion stock buyback program backed by ethereum holdings demonstrates institutional confidence, while the DOJ's regulatory clarity provides a more stable legal environment for crypto developers.

BTCC financial analyst Mia notes, 'The combination of institutional adoption through SharpLink's MOVE and regulatory progress creates a constructive backdrop for Ethereum. Morpho surpassing $10 billion in deposits further validates DeFi's growing maturity and ETH's central role in the ecosystem.'

Factors Influencing ETH's Price

SharpLink Approves $1.5B Stock Buyback Backed by Ethereum Holdings

SharpLink's board has greenlit a $1.5 billion stock repurchase program, leveraging its Ethereum holdings as collateral. The buybacks will be executed when the company's share price dips below the net asset value of its ETH reserves—a move signaling robust confidence in its crypto-backed balance sheet.

With 740,800 ETH in its treasury and a NAV ratio of 1.06, SharpLink's strategy mirrors the crypto-collateralized financial maneuvers pioneered by firms like Bitmine (NAV 1.17). This disciplined capital allocation framework aims to create shareholder value while demonstrating institutional conviction in Ethereum's long-term valuation thesis.

US DOJ Provides Legal Clarity for Crypto Developers Amid Regulatory Shift

The U.S. Justice Department has signaled a more lenient stance toward cryptocurrency developers, clarifying that writing code without criminal intent does not constitute a crime. Acting Assistant Attorney General Matthew Galeotti emphasized this shift during the American Innovation Project Summit, marking a departure from prosecuting developers for failing to register as money transmitters.

The announcement follows the high-profile case of Tornado Cash founder Roman Storm, whose conviction highlighted regulatory tensions around decentralized platforms. The DOJ's disbandment of its national cryptocurrency enforcement team further underscores a broader pivot toward accommodating digital assets.

Decentralized exchanges, often criticized for lacking transaction oversight, may find relief in this policy adjustment. The move aligns with industry demands for clearer guidelines amid ongoing debates over anti-money laundering compliance in crypto.

Morpho Surpasses $10B in Deposits, Marking a DeFi Lending Breakthrough

Morpho has eclipsed $10 billion in total deposits, cementing its position among the top decentralized lending protocols. The platform's innovative approach—pairing lenders and borrowers directly rather than through pooled liquidity—has delivered superior rates and fueled rapid adoption.

Active loans now stand at $3.5 billion with $6.7 billion in total value locked, reflecting robust utilization of its three core products. While built atop Aave and Compound's infrastructure, Morpho's architecture demonstrates growing demand for alternatives to traditional DeFi lending models.

Multi-chain expansion has been instrumental to Morpho's growth. After launching on Ethereum, deployments across Arbitrum, Polygon, and Base have significantly widened its user base. Both retail and institutional participants are increasingly drawn to its optimized yield opportunities.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum shows promising growth potential across multiple time horizons. BTCC financial analyst Mia provides the following projections:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $5,200 - $6,800 | Continued institutional adoption, ETF developments, and scalability improvements |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, enterprise blockchain integration, and Ethereum 2.0 full implementation |

| 2035 | $25,000 - $40,000 | Global digital economy integration, CBDC interoperability, and mature staking economy |

| 2040 | $45,000 - $75,000+ | AI and blockchain convergence, tokenized real-world assets, and established store of value status |

These projections consider current momentum, historical growth patterns, and the expanding utility of the Ethereum network across various sectors.